Finance Friday #20

Expected Returns

When it comes to investing you need to think about your expected returns. If you are planning for something in the future, such as retirement, you need to project your current situation forward to see if you are on track to reach your goals. If you are, great! If not, you may want to make adjustments to your plan or double down on what you are currently doing. In order to project your future returns you need to know the historical averages so that you have an idea of what to expect going forward. Of course, past performance is no guarantee of future performance but it is a good place to start. Obviously we cannot predict the future with 100% accuracy. You should also determine if you want to consider inflation into your projections because inflation will have a huge impact on your future money. A dollar today is not worth the same as a dollar 30 years from now.

Inflation has been all over the news and the discussions for the past few years but I bet you never heard or thought about inflation before 2021. When it comes to the impact it can have on your retirement, it is a good exercise to consider. The Bank of Canada’s target is to keep inflation within a 1-3% range and historically they have mostly achieved that goal. 2021 was the first time that we have experienced significant inflation above the Bank’s target rate in decades. There have been brief periods that inflation spiked over 3% but it did not last long. 2021 through 2023 was the first time we have seen persistent inflation for an extended period of time. This period was obviously outside the norm and was caused by a black swan event that would be impossible to predict anything like it again in the future. Therefore, you are safe to assume that inflation will be between 1% and 3% going forward.

Then you need to ask yourself if you want to include this projection of inflation into your future plans and how it will affect your savings. Over the course of 30 years of 2% compounding every year can have a big impact on the future value of your money. Of course there are many variables to consider when making projections about the future and trying to plan around those variables. The important thing is that you take these variables into consideration and how they will impact your future money. One of the main reasons to invest your money is to outpace inflation. If your money did not lose value over time we would not need to invest in risky assets in order to fund our futures, we could save our money in the bank and live happily ever after. Unfortunately life doesn’t work that way and we need to grow our money if we want to live a comfortable life in the future without needing to work. Everyone’s financial situation is unique and therefore it is up to you to think about these things and how to plan for your future.

If we project inflation to be 2% every year for the foreseeable future, this should be considered our hurdle rate when making investments. Hurdle rate simply means the rate of return you want to get in order for the investment to make sense. If inflation is 2% and you expect a return of 1% that investment doesn’t really make much sense because in real terms that investment lost 1% due to inflation. Your goal should be to outpace inflation so that your money grows over time. How you decide to price inflation into your projections for the future will determine your actions today. If you price in 2% inflation into your needs for your goal, you will need a much larger sum of money than originally thought. Or you can price inflation into your savings rate. For example, if you save $500 a month for the first year, the following year you can then price in inflation of 2% or whatever the actual inflation rate was for the previous year. Your savings rate for the following year with inflation of 2% priced in will now be $510 per month. You do not need to price inflation into your savings as long as you are aware that inflation will have an impact on your future money. If you are saving for a very long period of time, you will likely review your savings and projections periodically and make adjustments along the way. There is no way to predict what will happen in the future so it is a good idea to be flexible with your savings and retirement goals. There is a good chance you will be forced to make changes over the course of your working life. The main thing is that your money is invested and growing beyond the rate of inflation.

Expected Rate of Return By Asset Type

The rate of return is how much you expect your money to grow over a one year period. Over many years, the average rate of return is calculated as your compounded annual growth rate. This is the number you see advertised by many investors as to what you can expect from your investment. For instance, the stock market generally returns around 10 or 11% but it very rarely ever returns 10% in a given year. One year it might be up 25% and the next year down 5% and the following year back up 15% and so on. Over long periods of time the compounded annual growth rate has historically been around 11% for the past 100+ years. If you price in 3% inflation, the compounded annual growth rate for the stock market is 8%. When making projections it is always a good idea to be on the more conservative side, that way if things don’t go exactly according to plan you won’t be as shocked and disappointed and if things go better than expected you will be pleasantly surprised.

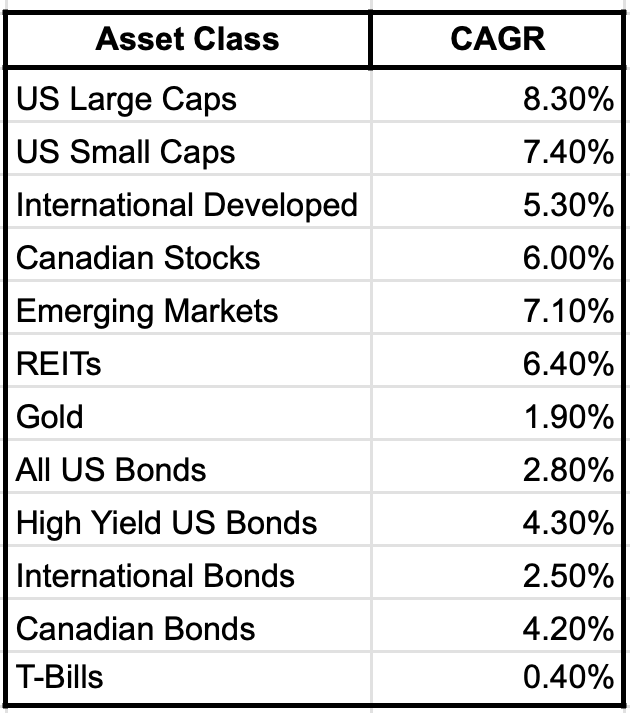

There are many studies that look at the historical rate of return of different asset types. Looking at a study that looked back at data from 1985 to 2023, taking into account US inflation data and assuming that all dividends were reinvested, US Large Cap stocks (S&P 500) has performed the best at an annual rate of 8.3%. The second best asset class has been US Small Cap stocks returning 7.4% annually. Canadian stocks have returned 6% annually, and REITs have returned 6.4%. Listed below is every asset class in the study.

Use this data to make projections about your financial future as well as when making financial decisions. The assets with lower returns tend to be less risky whereas classes with higher returns are more risky. This is where risk and reward play a balancing act. Higher risk assets tend to reward higher returns, not always but in general. When it comes to your long-term savings it is best to invest in assets that have high returns, such as Large Cap US equities (S&P 500). For short-term investments you want to invest in safer assets such as T-Bills, GICs, Money Market Funds, and bonds. When planning long-term investments and financial goals at a certain point you will want to begin taking money out of risky assets and moving them into less risky ones so that the money is available when you need it. Retirement income for example should be removed from equity markets a few years before you need it and invested in safer assets such as money market funds or GICs. The rate of return will be far lower but your income will be protected.

It is important to understand the assets you invest in and the rate of return you can expect with a given asset. It is equally important to be aware of the risk factors associated with an investment and how each asset class functions and performs over time. Using all of this information, you can then make educated projections about your savings and make investment decisions based off of this information.

For more detailed information on historical rates of return visit here